It’s important in any real estate field to be able to distinguish the difference between a property’s deed and the property’s title. They’re both dealing with determining ownership of property, so the water tends to get a little muddy here and it can be confusing as to what the actual difference between the 2 terms is. Many people actually think they're referring to the same thing. Since these terms serve different purposes, it can cause trouble for people involved in selling or buying land for sale who don’t know the difference.

Property Titles

What is a title?

A title is a legal concept of ownership that means you own the rights to a property. Here's where some of the confusion comes in. Although the state can issue a certificate of title, this term is an abstract idea meant to describe the relationship between the titleholder and the property. The relationship described is the holder's rights to use the property. Put simply, it's a bundle of rights. These rights usually include the ability to own, control, use, dispose of, and sell the property, transferring the title to someone else. Basically, it means you can do what you want with it, as long as it’s legal.

Full vs. partial title ownership

A title may represent a full interest or a partial interest. Full title ownership means the owner accepts all rights and responsibilities and doesn’t share them with anyone. Partial title ownership means you share the property rights with other parties.

Clear title

Another important element to consider is whether or not the title is clear. Often there will be liens or levies on a title. These are referred to as encumbrances. A lien is a claim granting the lien holder money if the property is sold. This is done to make sure debts are paid. The most common form is when you take out a mortgage, the mortgage company will put a lien on your property and hold the title until the mortgage is paid in full. To learn more about liens, check out our blog post discussing property lien basics. A levy is actually when the property is taken to satisfy a debt. A clear title is where there is sole undisputed ownership of property because there are no liens or levies.

It’s probably not a surprise to you that everyone isn’t honest and that a lot of mistakes have been made when it comes to titles and transferring ownership. It may surprise you if it’s put it a different way… people have been known to try to sell properties they didn’t own. They might conveniently “forget” to mention there’s a lien on the property. Maybe they suspect you won’t like the fact that an easement gives the neighbor the right to access your property in order to get to theirs and they don’t tell you. There have also been many circumstances where problems are caused because previous ownership wasn’t recorded correctly.

A title search is one way to try to catch these types of issues before a property is purchased. ProTitleUSA and U.S. Title Records are solid resources that offer title searches at reasonable prices, or you can visit the courthouse in the county the property is located in and do your own title search for free.

Abstract of title

An abstract of title is a detailed collection of all the documents associated with a particular property that affect the status of the title. It's essentially a thorough summary to determine if the title is free and clear and make sure the owner has the right to sell the property. If this sounds just like a title search, it’s because they’re similar. The difference is often title searches may go back 40-60 years, whereas an abstract of title traces property records back to the point where records are no longer available. Abstracts typically cost in the neighborhood of $75-$125, although pricing can vary depending on the service provider, the value of the property, the complexity of the research, and the time it takes to complete it.

Title insurance

Lenders, buyers, and sellers can all benefit from title insurance. Title insurance protects these parties from damages or losses because of past events. Examples of what this insurance would cover are liens, easements, encroachments, and inaccurate documents. Money Crashers reports the average cost of a title insurance policy is $1,000, although they can range from as low as a few hundred dollars to a few thousand.

Property Deeds

What is a property deed?

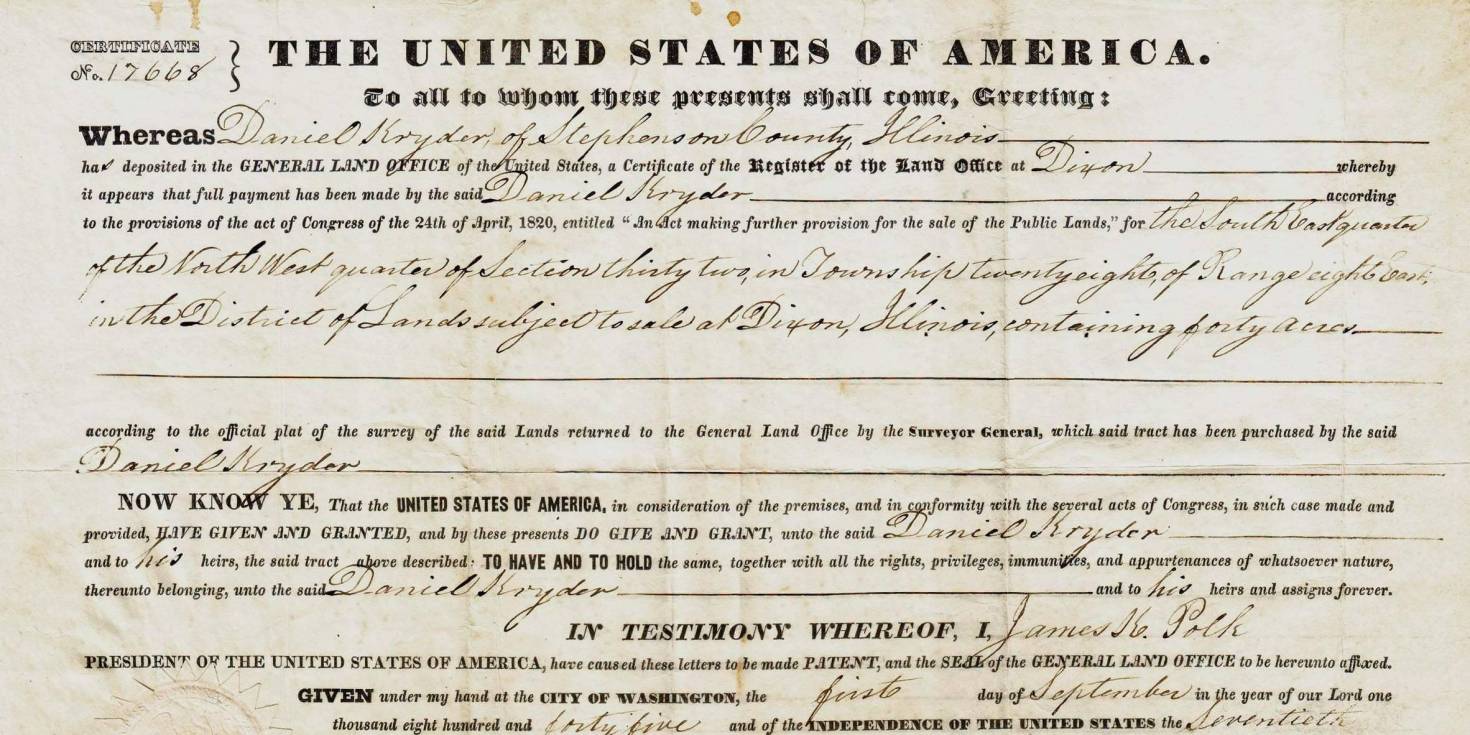

A property deed is a written, signed, notarized instrument that conveys the title of real estate from a grantor (seller) to a grantee (buyer). A deed is the tangible evidence of a title and must be executed correctly to be legally operative. Put another way, a deed is the vehicle that transfers the title from one owner to another. It's supposed to be recorded in land records usually at the courthouse in the probate or assessor's office, so there will be access to who owns any given property and who has rights to those properties.

Types of deeds

As there are several different forms of title ownership, there are different types of property deeds.

General warranty deed - The seller guarantees the title is clear and as a result has a legal right to sell the property to the buyer. The buyer is protected against title defects that extend throughout the entire history of the property.

Special warranty deed - Similar to a general warranty deed, the seller guarantees the title is clear and has a right to sell the property to the buyer. Unlike the general warranty, however, the buyer is only protected against title defects that originated during the time the current seller was in possession of the property.

Quitclaim deed - The seller terminates, or "quits," any right and claim to the property, allowing them to convey to the buyer. Although the legal interest the seller has is transferred to the buyer, no guarantees are made including whether or not the seller actually owns an interest in the property or if the title is free and clear.

Trust deed - The property title is transferred to a neutral third party whose job is to hold the title as security or "insurance" for a debt between a lender and a borrower. When the debt is completely paid off, the title is transferred back to the borrower.

Tax deed - When a property owner doesn't pay the property taxes that are due, the ownership is eventually transferred to a government entity. The government has the legal right to sell the property so they can collect the delinquent taxes and transfer ownership to the new owner.

U.S. Legal Forms allows you to look at examples of different types of property deeds. Since they vary from state to state, you’ll first need to select the appropriate state you’d like to see an example from.

Legal ownership and rights are relevant and should be taken seriously. Even though this article is basic in nature, hopefully, it can clear up some of the confusion surrounding property deeds and titles. If you're reading this because you're trying to sell or buy a piece of property, take a look at our sell your land section or our land for sale.